Welcome back to my financial statement modelling blog! In my initial post, we examined the fundamentals of financial statement modelling and outlined a simplified plan for the development of our financial statement model. This week, we will commence with “Step 1,” where we will engage in a brief discourse, during which we will examine the sources from which we will collect the majority of the essential information required for our model.

The data collection process will commence with the careful examination of Walmart’s 10-K filing. The subsequent section provides a detailed, step-by-step guide on how to access and download Walmart’s 10-K filing, should you desire to follow along.

Data Collection

To begin, we’ll go directly to Google and search for “Walmart Investor Relations. ” Subsequently, we’ll click on the first link, which is expected to direct us to a version of the page illustrated below. Please note that this page may have undergone modifications depending on when you read this blog post.

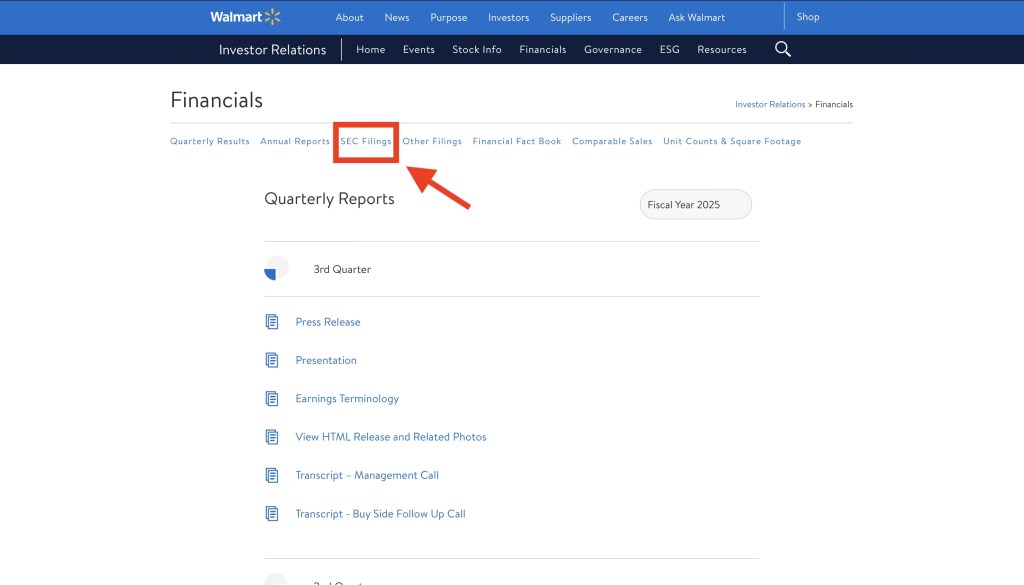

Please select the “Financials” link as indicated above, which will direct you to the “Financials” page. Upon arrival, kindly click the “SEC Filings” link.

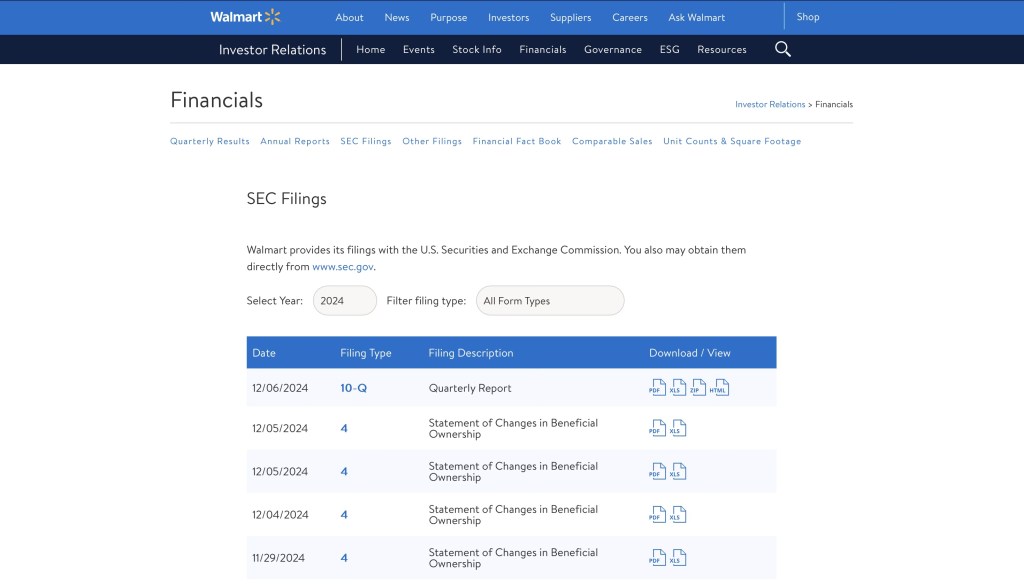

When we reach the “SEC Filings” page, we immediately have access to all pertinent financial data necessary for formulating our model.

The filings of primary concern are the 10-K filings, which constitute the annual financial report that summarises a company’s financial performance and business activities over the preceding year. This report informs shareholders and potential investors about the company’s financial health.

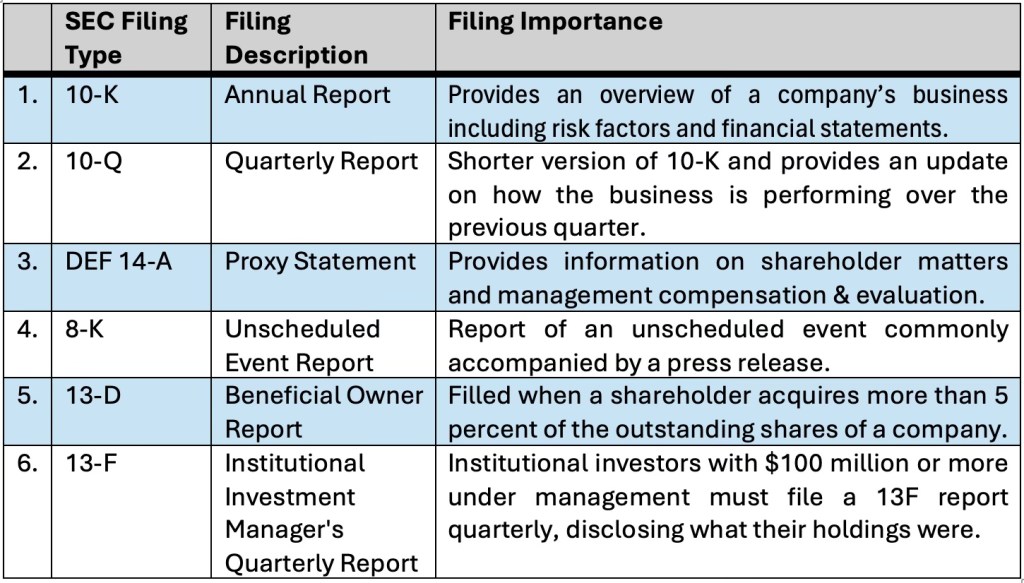

Prior to proceeding, it is essential to emphasise the six most significant SEC filings that every financial enthusiast should be familiar with. The table below breaks down these filings by name, description, and their respective importance:

For our purpose, we will primarily review the annual 10-K filings spanning five years, specifically from 2024 to 2020. However, we will extend our timeline on specific schedules to mitigate the impact of the pandemic on our future forecasts.

This blog serves as a concise overview of the specific locations from which we will be gathering most of our data on Walmart, should you wish to accompany us throughout our analysis.

Additionally, it is essential to examine Walmart’s latest 10-K filing and adopt a comprehensive perspective on the document to evaluate the significance of its various sections. The 10-K contains an extensive array of information, and it is crucial to review the filing efficiently while extracting the most pertinent information.

Walmart’s 2024 10-K Filing

An effective financial statement model must be founded upon a comprehensive understanding of a company’s operations, governance, strategic objectives, external environment, and historical performance. The 10-K filing serves as a document that consolidates pertinent information, aiding in the analysis of both the company and its surrounding context.

What we must recognize is that this document provides us with a wealth of information, and it is our responsibility to consolidate it and identify the most critical components that will enable us to develop our financial model.

To effectively ascertain what is of significance, we conduct an initial review of the statement. During this process, we identify and highlight any pertinent information that we consider vital, which will subsequently aid us in establishing assumptions for our forecasts.

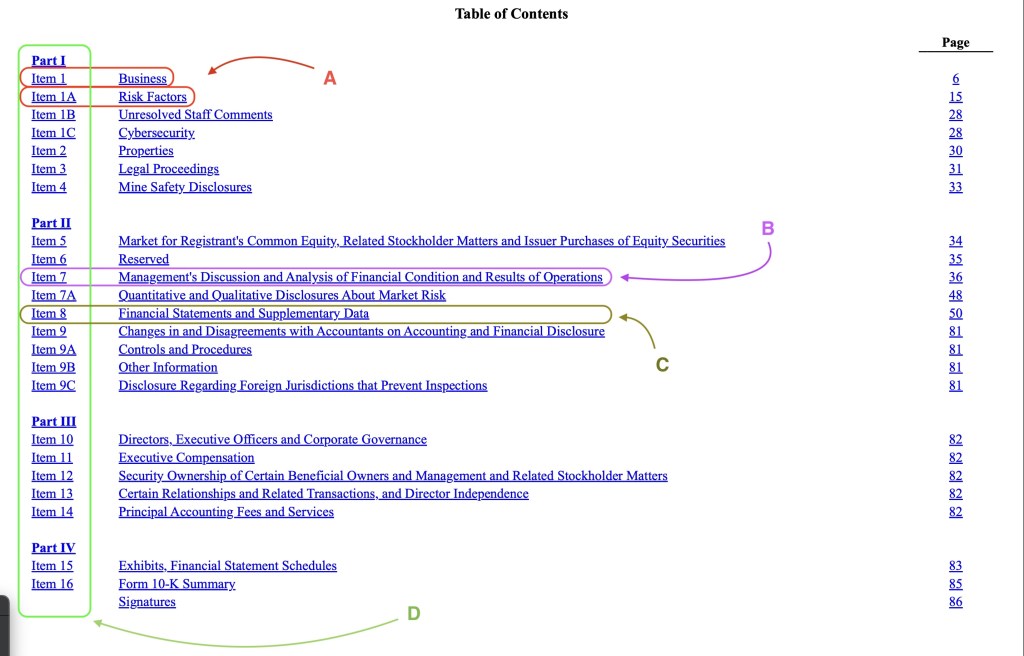

The figure below shows the table of contents for Walmart’s 10-K. I have outlined four sections that are of particular significance to me before I start my analysis of the company, and I break them down as follows:

- A – This section of the Form 10-K provides an introduction to the business and its operational model. It elucidates the nature of the business activities, operational methodologies, and mechanisms for generating revenue and profits, in addition to highlighting the distinguishing characteristics that set it apart from its competitors.

We are also presented with an overview of Walmart’s business risks, which include factors pertinent to the company itself and the industry in which it functions. From these risks, we can identify significant elements that are crucial for understanding the sensitivity of Walmart’s financial performance in relation to those risk factors. These elements must also be taken into consideration when projecting Walmart’s financial performance. - B – The Management Discussion & Analysis (MD&A) section is absolutely critical for understanding a business and its key drivers. The MD&A provides qualitative insights into the company’s operational performance, strategic direction, and management’s perspective on current and future challenges. It highlights critical factors such as revenue trends, cost dynamics, market conditions, and risks that may not be evident from the numbers alone.

Moreover, it offers context for significant financial changes, discusses the impact of industry trends, and outlines management’s strategies to address competitive pressures or economic shifts. The MD&A thus bridges the gap between financial figures and the broader business narrative, making it an essential tool for evaluating a company’s health and potential. - C – The Financial Statements and Supplementary Data will not be particularly significant when endeavouring to understand the company and its fundamental drivers. Nonetheless, once we initiate the modelling process, the information derived from the financial statements will prove to be essential. This is particularly important as we initiate the process of modelling revenues, costs, and working capital as well as establishing their corresponding schedules.

- D – This serves as a structural consideration to note. It is important to recognise that 10-K forms are divided into four distinct sections, as indicated above.

The subsequent step following the review of this information involves conducting a preliminary examination of the 10-K form to identify and emphasise any critical information pertinent to the formulation of a financial model. Subsequently, this information will be analysed and summarised.

Upon completing our analysis, we will possess a comprehensive understanding of the nature of Walmart as a company, including its revenue and cost drivers. Moreover, the extensive information gathered will assist us in formulating our assumptions for the financial forecasts.

Conducting an analysis of Walmart and its surrounding environment will pose the greatest challenge in the development of our financial model and will, therefore, require the highest level of consideration and effort to formulate the assumptions essential for our model.

Conclusion

Thank you so much for sticking with us until the end of this blog post! We truly appreciate your engagement. We can’t wait for you to join us for our next financial statement modelling blog post, which will be coming out on November 17th. Together, we’ll explore Walmart’s 10-K filing and deepen our understanding of the company and its business environment. Until then, keep that curiosity flowing, stay informed, and we’re really grateful for your readership!

Leave a comment